October 24, 2022 HM Land Registry Letter: Notice of Entry of a Restriction, explained…

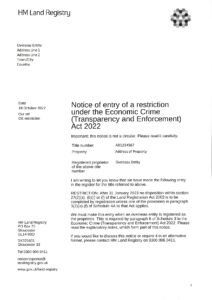

In August, we wrote about a Companies House letter outlining new obligations for overseas entities that owned property or land in the UK. Now it appears to be the turn of HM Land Registry. Many of our register of overseas entities clients have been in touch over the last two weeks concerned by a letter titled: “Notice of entry of a restriction under the Economic Crime (Transparency and Enforcement) Act 2022” (see below). Upon viewing the letter it’s easy to understand why. Here we explain what it means and what you need to do.

Why has HM Land Registry written to you?

From 1 August 2022, overseas entities that own property or land (or long-term lease) in the UK have been required to register with UK Companies House as an overseas entity. The deadline for doing so is 31 January 2023. The letter updates owners that in accordance with the law a restriction has been placed for after the 31 January 2023. Importantly, the letter does not represent new news, HM Land Registry were always going to do this during the transition period (1 Aug 2022 – 31 Jan 2023).

Receiving this letter also does not mean that you have done anything wrong. This restriction will be added to the titles owned by all overseas entities, whether or not they have successfully registered on the Register of Overseas Entities.

What is a restriction?

This means that no disposition (generally being, for these purposes, a transfer (including the transfer of a charge), lease or charge by way of legal mortgage) shall be registered unless the overseas entity registers or there is an exception.

What are the exceptions?

An overseas entity would have to prove one of the following statutory exceptions applied at the time of disposition, otherwise HM Land Registry will not register it:

- a statutory obligation or court order;

- a contract made before the restriction is entered in the register;

- a power of sale or leasing conferred on the proprietor of a registered charge or a receiver appointed by such a proprietor;

- the Secretary of State gives consent; or

- because of an insolvency arrangement.

What do you need to do?

There is no need to contact the Land Registry unless you believe you have received the message in error. For most overseas entities, the next step should be the register with Companies House, if they have not already.

The restriction will not come off after you have registered, but you will have complied with the law. As well as the restrictions there is also a daily fine of up to £2,500 for failing to comply and potential imprisonment.

How can Elemental help?

If any of our existing clients have received the letter and still have concerns. Please get in touch with your usual Elemental contact. Elemental is the market leader for Register of Overseas Entities services and we would be happy to help any overseas entities that are affected by the new rules.

The above note is general in nature and for informational purposes only. It is not intended to be legal advice. If you are in any doubt as to your obligations you should obtain independent legal advice.