August 22, 2022 Companies House Letter to Overseas Entities

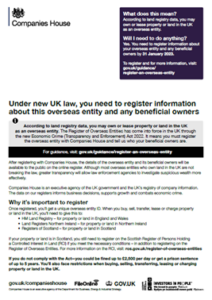

If you’ve received a letter from Companies House requiring you to register your overseas entity and beneficial owners, be assured you are not alone. Companies House began writing to overseas entities after the new rules were introduced on 1 August 2022. Based on Land Registry data, we estimate Companies House will be sending over 30,000 of these letters to around 150 countries. Though the vast majority will be making their way to the British Virgin Islands, Jersey, Guernsey and Isle of Man (where 70% of affected entities are registered).

If you’ve received a letter this article will give you some important additional information.

Wh at do you need to do after receiving the letter?

at do you need to do after receiving the letter?

The letter briefly explains that you will need to appoint a UK regulated agent. Companies House mentions “accountants” and “legal professionals” as two firms that can help but there are other firms who could help you as well:

- credit institutions

- financial institutions

- auditors, insolvency practitioners, tax advisers

- trust or company service providers

- estate agents and letting agents

It is possible to file the information yourself; however, a UK-regulated agent must verify the information before it is filed and so you will not be able to complete the process without the help of one. In addition, the letter also advises “it’s quicker and easier to ask a UK-regulated agent to register and file the information for you”. This is because otherwise, the regulated agent has to complete the verification and then, after registration, log on and confirm all the details of the verification again.

However, it is important to understand that many providers are not offering this service due to the complexities and risks involved.

Why it’s important to take action now

You have until the 31st January 2023 to register, but this deadline is misleading and you may not have as much time as you think. Companies House clearly explains that you will also not be able to buy, sell, transfer, lease or charge the property without the ID as well as the financial and criminal penalties. However, it’s important for overseas entities to also consider the following:

- There is a reluctance amongst many UK-regulated agents to offer the verification service because there are criminal sanctions associated with getting it wrong. Industry bodies like the Law Society have even written to members advising they proceed with “extreme caution” and many law firms have written extensively on the challenges of carrying out the work.

- Although our experience of helping clients with the register is that the process is currently fairly smooth, we are also aware that there are only a few entities on the register. Three weeks after the register went live there are 125 entities in total. A long way from the required 30,000. How well the current processes cope or when they will move to a more automated one is unknown.

- Although you may not be buying or selling land, we are seeing a number of clients coming to us stating that their bank requires an Overseas Entity ID before completing a refinancing deal. If you may be in this situation it is worth checking.

- Identifying beneficial owners sounds simple, but in our experience that’s not always the case. Particularly where there are trusts, fund structures or complex corporate structures, the answer is not always what you might think.

- Finally, if the entity has a trust as a beneficial owner the process could take a long time to complete. This means all individuals back to day 1, which could be decades, and all that information will need to be verified even if they are deceased.

- However, we do think the letter is misleading and could catch some out. The letter states “if any trustees of a trust are registrable beneficial owners, you’ll also need to give information about that trust. This includes details about the beneficiaries, current or past beneficial owners, settlers, grantors, and interested persons”. (Our emphasis)

- This isn’t strictly true. The correct wording is in the BEIS technical guidance (para 9.8(c)) and also in ECTEA (Schedule 1, Part 5, para 8(1)(c), it says: “each person who has at any time been a registrable beneficial owner in relation to the overseas entity by virtue of being a trustee of the trust”. Though “beneficial owner” isn’t incorrect, it must be by virtue of being a trustee. It is perhaps not helpful that the letter from Companies House does not highlight the need to disclose trustees who have at any time been a registerable beneficial owner. This is one of the key aspects of verifying trusts. Given the well-documented challenges of verifying trusts, this could save some clients a lot of time.

In summary, although the deadline is 31 January 2023, depending on the complexity of your structure and who carries out the verification process, you will probably need to start much sooner. There is no doubt that some entities will need to start now.

How can Elemental help?

Elemental is a UK-regulated agent that has helped over 1,600 clients from all over the world with their UK compliance requirements. As a corporate services provider that focuses on UK compliance, we offer our services at a scale that enables us to be more cost-effective than other types of agents. We are authorised by Companies House and we offer a fully managed register of overseas entities service. We can help you identify your beneficial owners, verify all the information and register with Companies House, as requested by the letter. To find out more about our service visit our Register of Overseas Entities service page or contact us.