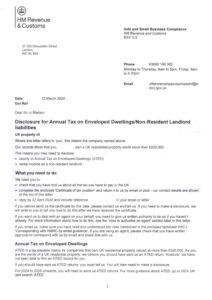

April 18, 2024 HMRC letter to overseas entities owning UK property

Overseas entities have been receiving letters from HMRC reminding them of their obligations under two schemes: the annual tax on enveloped dwelling (ATED) and the Non-Resident Landlord Scheme (NRLS). If you have received a letter, here’s what you need to know.

Why have you received a letter?

It is likely that HMRC is using information from the Register of Overseas Entities. In the past HMRC has clearly stated “information on the register will be available to HMRC and will be used to identify tax non-compliance of: overseas legal entities, overseas legal arrangements and beneficial owners.”

If the records show that the entity owns residential property in the UK, then it may need to file an annual tax on enveloped dwelling return and/or tax returns under the non-residents landlord scheme. HMRC targets those whose records are currently showing that they have no filing.

What is ATED?

ATED is an annual charge payable on UK residential property valued at more than £500,000. Each year those affected need to file an ATED return and pay the tax by the end of April. This year’s deadline is 30 April 2024.

You may need to make an ATED return if:

- You own UK residential property valued at over £500k

- The property is owned through a company, a partnership in which one partner is a company, or a collective investment scheme or you have significant control over the property.

What are the other disclosures mentioned by the letter?

The letter may also mention other related taxes and disclosures typical for overseas landlords, for example the NRLS. Non-resident landlords of all forms (individuals, companies, partnerships and trusts) are subject to UK taxation on income and gains in respect of UK property. It may be that this is already being deducted at source e.g. by your estate agent. However, you will still need to let HMRC know.

It is worth landlords remembering that if NRLS is being dealt with at source, they may be missing the chance to offset any property related costs to minimise their overall tax bill.

If HMRC has no records of income tax and corporation tax for the overseas entities it will also likely flag that as well.

What do you need to do?

Even if you believe all your filings are up to date, you will need to respond to the HMRC letter by filing their enclosed form by the stated date. You can either do this yourself or many will choose to use an agent, such as Elemental. To appoint an agent you will need to use this form. If Elemental is already your registered tax advisor you will not need to do this.

What happens if you fail to act?

HMRC will likely assess the amount you owe and possibly open an investigation and consider penalties. Penalties are usually 100% of the tax due but can be higher.

How can Elemental help?

Elemental is a fully integrated corporate services firm and offers a range of services to help entities to comply with UK regulations. We are also the number 1 UK regulated agent for the Register of Overseas Entities. Elemental can help clients with the ATED, NRLS and corporation tax filings.