September 12, 2023 Companies House issues warning notices to Overseas Entities

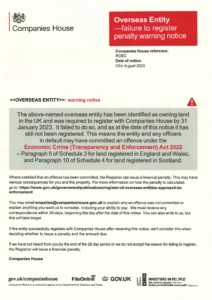

Companies House has again written to Overseas Entities that have not registered on the Register of Overseas Entities. This is not the first time Companies House has written to unregistered overseas entities. However, the tone of this new letter is different and represents an escalation.

If you have received this letter, here is some more information. We highly recommend you act on the letter as a matter of urgency as failure to do so can, as Companies House points out, have “serious consequences” for the individuals involved.

Why have you received the letter?

Companies House believes that the overseas entity is one of many that owns land (or has a long-term lease) in the UK. In August 2022 a new rule came into force requiring such overseas entities to register with the UK government and provide details of its beneficial owners or managing officers. Overseas Entities had until 31 January 2023 to register. That deadline has now long passed, and according to Companies House records the overseas entity still hasn’t registered.

This letter is an official “warning notice” that Companies House sends if they suspect an offence has been committed and ahead of any possible penalties.

What happens if you don’t comply?

The Register of Overseas Entities was rushed in and at the time of the January 2023 deadline the informal commentary was that criminal action was unlikely to be brought against entities that had failed to meet the deadline, especially if it could demonstrate that steps had been taken to comply. However, 7 months on from the deadline Companies House has strengthened its tone.

Failure to comply can result in either a fixed penalty or daily rate penalty (or both) and/or a prison sentence. The exact penalty will vary based on the level of culpability and harm in each case. There are also restrictions placed on the entity’s ability to buy, sell, transfer, lease, and charge their land.

What should you do?

Companies House has invited non-compliant entities to write to them to provide information including “anything you want us [Companies House] to consider”. According to Companies House enforcement guidelines published in June, they have confirmed they will be considering a range of factors when determining any penalties. Explicitly they state: “If an entity complies with the requirements before the end of the warning notice period, the matter will be reconsidered.”

Therefore, as was the case soon after the end of the transition period, it is strongly recommended that entities that have not already registered who believe they should, could mitigate the risk of any penalties by registering. An entity can not register itself. A UK Regulated Agent, such as Elemental must independently verify the information.

What happens after you have written to Companies House?

Companies House will confirm in writing that they have received your correspondence. A decision will not be made until all information provided has been considered. If a penalty is issued, there is an appeals process.

How we can help

Elemental is the market leader for Register of Overseas Entities services and is advising a number of law firms, corporate service providers, as well as clients on the new regime. Elemental offers a fully managed service and can help entities looking to comply as soon as possible. For clients who are looking to register as soon as possible we offer a priority service to fast-track your registration. If you need help with any matters relating to the Register of Overseas Entities please contact us.

The guide is not intended to be legal advice and should not be relied upon as such. If you are in any doubt as to your legal obligations you should obtain independent legal advice.